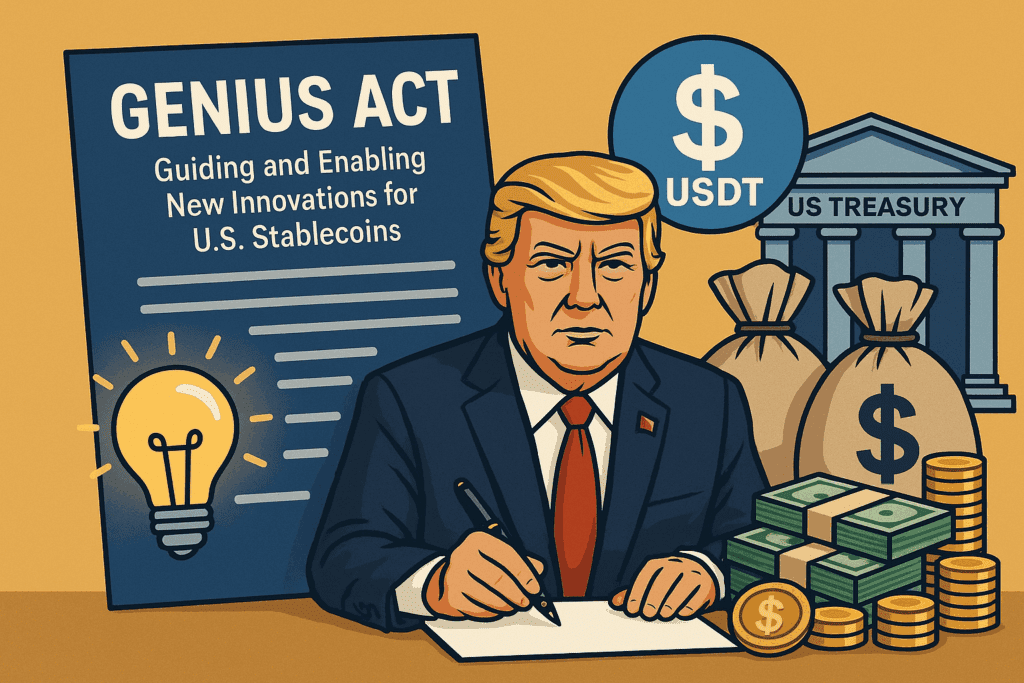

In today’s world of cryptocurrencies and digital finance, game-changing laws are emerging. One of these is the American Genius Act, which was recently passed and signed into law by President Trump. Officially known as the GENIUS Act (Guiding and Enabling New Innovations for U.S. Stablecoins), this law is genius not only on paper, but also in practice. Let’s take a look at why this is so, and how it affects the global financial system.

First, let’s consider how the Genius Act creates demand for the purchase of US Treasuries – US Treasury bonds. The Act sets strict rules for issuers of USD-linked stablecoins, where these digital currencies must be backed by high-quality reserves, including US Treasuries. This means that issuers like Tether have to buy huge amounts of these bonds to maintain the stability of their tokens. The result is increased demand, which lowers their price and makes it cheaper for the US government to borrow money. In essence, the Genius Act turns cryptocurrencies into a tool that supports the U.S. economy by increasing the attractiveness and liquidity of U.S. Treasuries.

Now let’s take a look at Tether, which is one of the biggest players in this space. Tether is operated by Tether Limited, which is part of the iFinex Inc. group (owner of the Bitfinex exchange). As early as 2024, if Tether were considered a separate country, it would be one of the largest holders of US Treasuries, or lenders of US Treasury debt. According to a tweet by Tether CEO Paolo Ardoin, Tether would be the seventh largest buyer of US Treasuries in 2024 compared to countries, with holdings worth approximately $33.1 billion. In 2025, these holdings of stablecoins like Tether and Circle grow further, with total USD stablecoin volume exceeding $236 billion, further increasing their influence on the Treasuries market.

However, the Genius Act goes even further and creates a monopoly for issuers of USD-linked stablecoins. Why? Because another US law was passed in parallel – the CBDC Anti-Surveillance State Act, which banned the Federal Reserve (the Fed, the central bank of the US) from issuing digital dollars, known as CBDC (Central Bank Digital Currency). This law prevents the Fed from entering the world of digital currencies directly, leaving the space exclusively to private issuers like Tether or similar companies. As a result, USD-linked stablecoins become dominant, without competition from the state.

And here comes an interesting corollary: anyone who owns USDT (Tether) or a similar stablecoin, which must now be backed by US Treasuries under the Genius Act, is indirectly a creditor of the US. Your digital dollars are backed by US debt, which means you are contributing to the funding of the US government. However, we as token holders do not receive the interest income on these bonds backing our USDTs. That yield goes directly to the Tether operator or another issuer of stablecoins backed by US Treasuries. Essentially, we, the ordinary users, are the ones providing the capital, but the big players – the issuers of stablecoins – take the interest profits.

Comparison with the EU and MiCA Regulation

To understand the genius of the Genius Act in a broader context, let’s compare it to the European approach, namely the MiCA (Markets in Crypto-Assets) regulation, which came into force in the EU in 2024 and is fully applicable to stablecoins from December 2024. MiCA regulates cryptocurrencies, including stablecoins (also called “electronic money tokens” or EMTs), but with a different focus than the Genius Act.

Under MiCA Regulation, funds received by EMT issuers in exchange for tokens must be secured as follows:

– At least 30 % of these funds are always kept in special accounts with credit institutions.

– The remaining funds received must be invested in safe, low-risk assets that are classified as highly liquid financial instruments with minimal market risk, credit risk and concentration risk and that are denominated in the same official currency as the currency to which the e-money token is linked.

Unlike the Genius Act, which explicitly supports backing US Treasuries and thus directly funds US Treasury debt, MiCA is more flexible. It does not require specific investment in EU or Member State sovereign bonds – generally safe and liquid euro-denominated assets such as bank deposits, short-term bonds or other low-risk instruments will suffice. This means that European issuers of stablecoins have more freedom, but at the same time it does not lead to the same systematic demand for European bonds as in the US. MiCA focuses more on consumer protection, transparency and risk prevention, including licensing and regular reporting requirements, while the Genius Act goes further in supporting the national currency and economy through mandatory backing by sovereign assets.

Another difference is in the approach to CBDC: While the US has banned the Fed from issuing CBDC, the EU is actively working on a digital euro (CBDC) that could compete with private stablecoins. This creates a contrast – in the US private USD stablecoins dominate, in the EU CBDC can strengthen public control over digital currencies, but the possibility of sovereign bond purchases via the ECB is very limited.

Comparison of the use of EUR stablecoins and USD stablecoins to finance sovereign debt

| Aspect | USD stablecoins (under the Genius Act) | EUR stablecoins (under MiCA) |

| Reserve cover | Mandatory 1:1 coverage by liquid assets, primarily US Treasuries (short-term government bonds). This directly increases demand for US Treasuries. | 1:1 coverage by liquid assets, at least 30% in banks, the rest in safe low-risk assets denominated in EUR. Coverage by EU sovereign bonds is not mandatory. |

| Impact on the national debt | They directly finance US sovereign debt – issuers like Tether and Circle hold billions in Treasuries, which lowers interest rates for the US and makes borrowing cheaper. In 2025, stablecoins hold more than $110 billion in Treasuries, comparable to countries like Germany or Saudi Arabia. | Indirectly or optionally – issuers can invest in European sovereign bonds (e.g. German Bunds or EU bonds), but it is not mandatory. The EUR stablecoin market is small (less than 1% of the global stablecoin market), so the impact on EU/Member States debt financing is minimal. |

| Dominance and risks | They dominate globally (99% of the market), strengthening the dollar as a reserve currency, but interest profits go to issuers, not holders. | Less dominance, risk of undermining European monetary sovereignty due to USD stablecoins; EU bonds (e.g. for recovery funds) could benefit if issuers choose this cover, but not systematic without obligation. |

| Overall effect | Genius for the US: Stablecoins become a tool for cheaper debt financing, increasing demand for Treasuries and boosting the economy. | Flexible but less strategic for the EU: Without mandatory sovereign bond backing, debt financing does not happen as directly, which can lead to dependence on USD stablecoins and higher costs for Europe. |

The Genius Act is thus brilliant in that it strengthens the dollar as the reserve currency of the world, strengthens US national security, and at the same time ensures that the private sector (and not the state) controls digital dollars. In contrast, MiCA offers a more balanced but less aggressive approach that prioritizes stability and protection, but without such a direct benefit to debt financing. For investors in cryptocurrencies, this means a more stable ecosystem, but also questions about transparency and fairness in the distribution of profits.

Ján Čarnogurský

Published 27.8.2025